With comprehensive control and utmost security measures, Wabash powered by Salt enables financial institutions to maintain secure communication consistently.

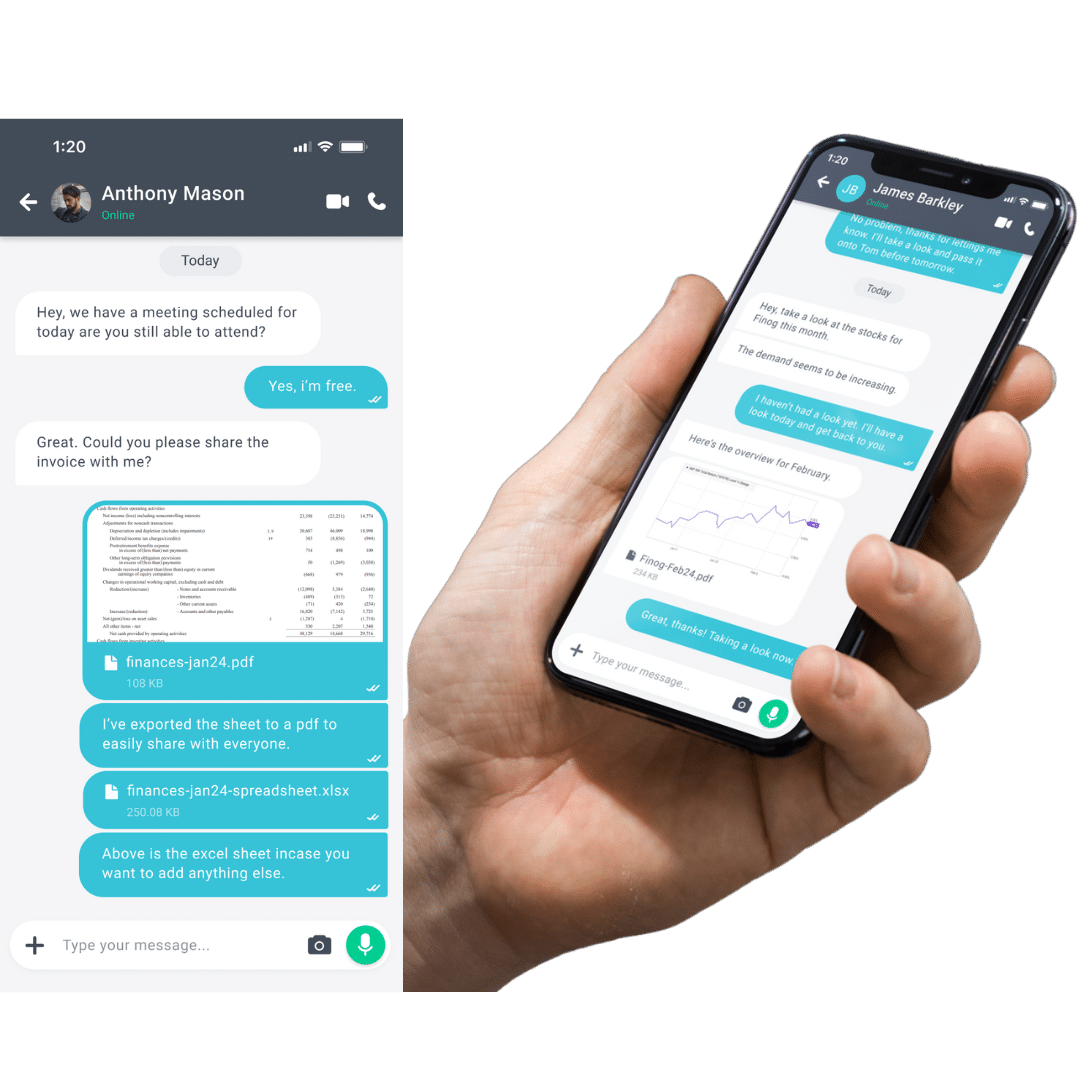

Critical to the security paradigm within the financial and banking industry is the robust protection of communications. Safeguarding business and client discussions is essential for maintaining the integrity of financial institutions. Wabash powered by Salt collaborates with global financial institutions, ensuring secure and compliant business continuity plans, even in situations where other systems may be compromised. In the context of regulatory considerations, such as those imposed by the Securities and Exchange Commission (SEC), the deployment of Wabash powered by Salt aligns with stringent requirements for maintaining the confidentiality and integrity of financial communications.

This proactive stance not only safeguards against cyber threats but also contributes to regulatory compliance, mitigating the risk of potential fines and legal repercussions imposed by regulatory authorities. According to a tracker, penalties from the SEC and CFTC totaled $9.2bn in 2023, including 32 fines for insider trading alone. The tracker also highlights that the $4.3bn in penalties handed out by the CFTC was an all-time high, including the joint fine against Wall Street banks over the use of consumer messaging apps, employee communications, and improper record-keeping practices.

Implementing the features of Wabash powered by Salt offers a proactive and robust defense against cyber threats, significantly aiding in the avoidance of potential fines levied by regulatory bodies such as the Securities and Exchange Commission (SEC).